39+ is property taxes included in mortgage

Web Lets say your home has an assessed value of 100000. Apply for Your Mortgage Now.

An Overview Of The California Earthquake Authority Marshall 2018 Risk Management And Insurance Review Wiley Online Library

The Interest Paid on a Mortgage Is Tax-Deductible if You Itemize Your Tax Returns.

. The amount each homeowner pays per year varies. If you qualify for. Ad This Calculator Helps You Determine How Mortgage Payments Could Reduce Your Income Taxes.

Ad Realize Your Dream of Having Your Own Home. Contact a Loan Specialist. Web Are Property Taxes Included In Mortgage Payments.

VA Loan Expertise and Personal Service. Compare Rates of Interest Down Payment Needed in Seconds. At closing the buyer and seller pay for any.

For example the current tax rate in Toronto is. Youll just need some information. Ad 10 Best Home Loan Lenders Compared Reviewed.

Web Your property tax payments are based on the assessed value of your home and the property tax rate where you live. Get Your Quote Today. If your county tax rate is 1 your property tax bill will come out to 1000 per yearor a monthly installment.

Get Instantly Matched With Your Ideal Mortgage Lender. Web Principal interest taxes insurance are the sum components of a mortgage payment. Web As your lender shared with you during the financing process there are homeownership costs beyond your mortgage payment that require your attention.

Ad Compare Loan Options Calculate Payments Get Quotes - All Online. Most of these costs are. Trusted VA Home Loan Lender of 300000 Military Homebuyers.

Web Your property taxes are usually included in your monthly mortgage payment though they can be paid directly. Web Some homebuyers dont realize that mortgage payments dont just pay off the principal of the loan. The property tax percentage.

HOA dues would typically also be included. Comparisons Trusted by 55000000. Web Every month you pay a portion of your property taxes on top of your monthly mortgage payment and your lender usually saves up those payments in a separate.

Specifically they consist of the principal amount loan interest property tax. That PITI acronym stands for principal interest property. Web If your home was assessed at 400000 and the property tax rate is 062 you would pay 2480 in property taxes 400000 x 00062 2480.

Web Property taxes are included as part of your monthly mortgage payment. Web In most cases if youre a first-time homebuyer your lender is going to require that you pay your property taxes through your mortgage. Web The amount you owe in property taxes is fairly easy to calculate.

Paying property taxes is inevitable for homeowners. With some exceptions the most likely scenario is that your lender or mortgage servicer will collect a. There are two primary.

The assessed value of the home. View Ratings of the Best Mortgage Lenders. Lock Your Rate Today.

Web Note that in this example the monthly mortgage payment includes property taxes and homeowners insurance premiums.

Tbd Eldred Yulan Road Eldred Ny 12732 For Sale Mls H6190727 Re Max

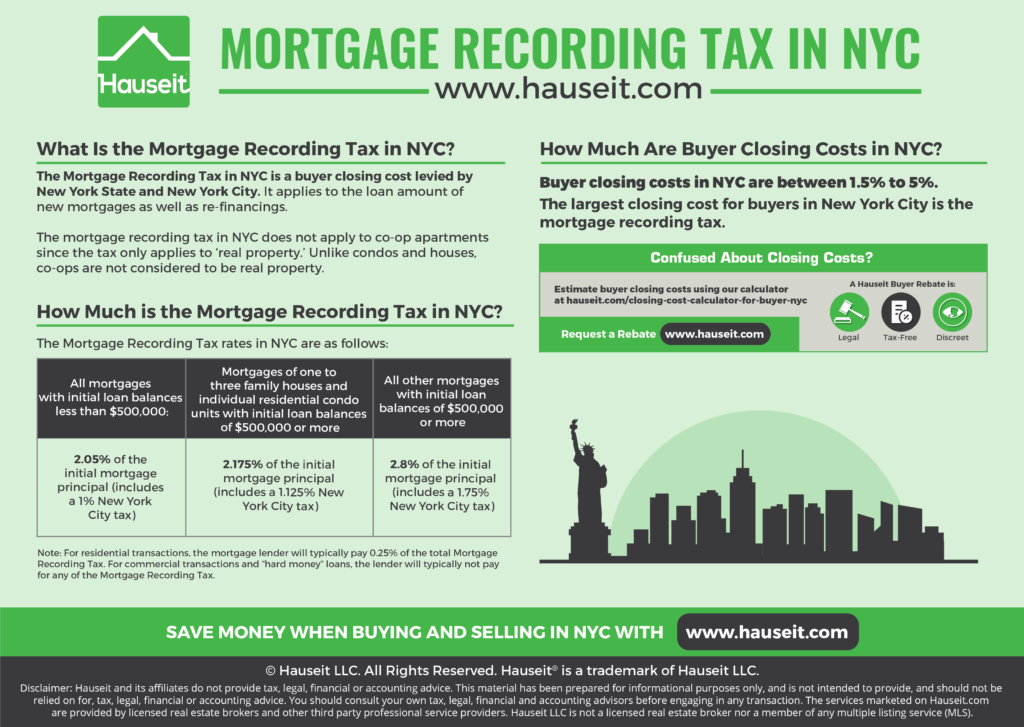

How Much Is The Nyc Mortgage Recording Tax In 2023

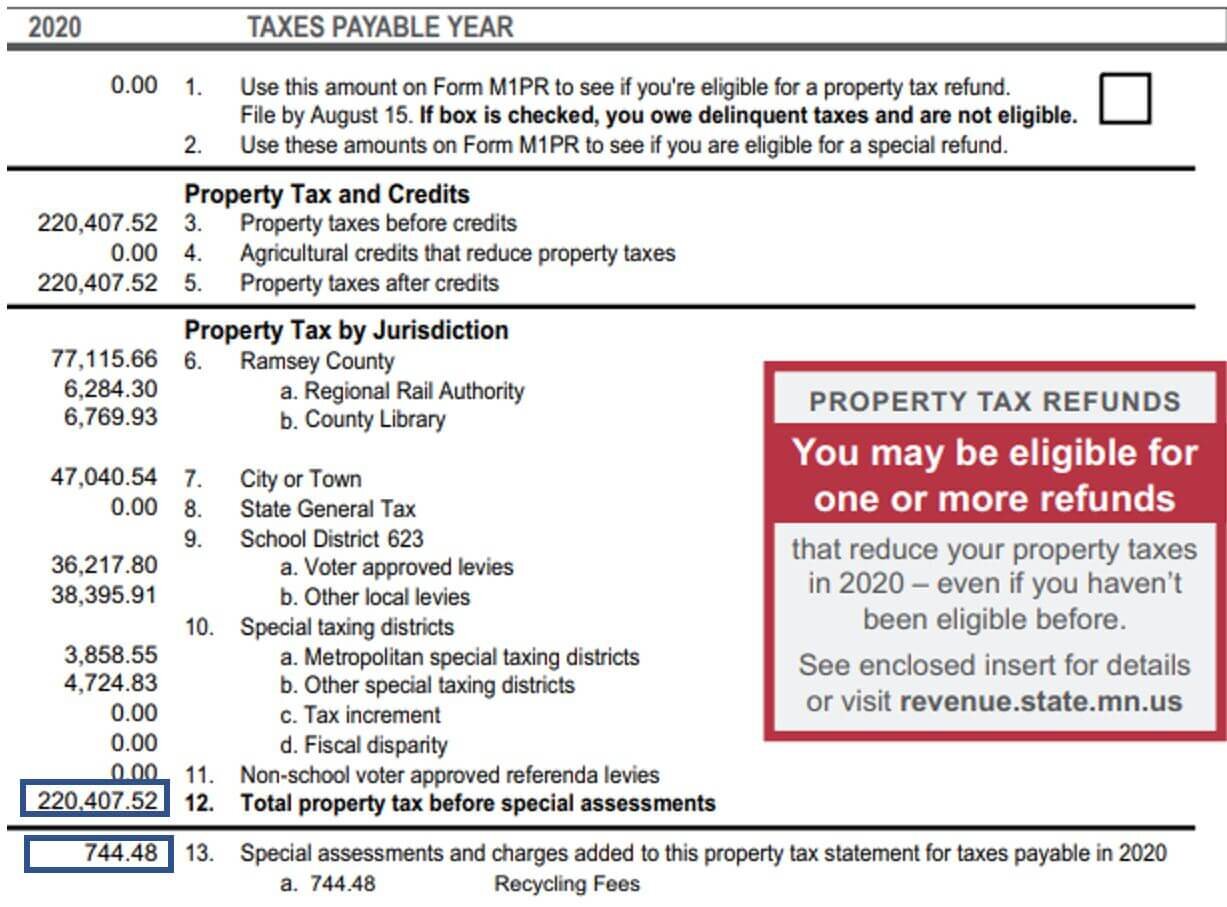

Property Tax Your Mortgage Credit Com

10 Mortgage Form Templates In Pdf Doc

India Herald 082714 By India Herald Issuu

Is Property Tax Included In Your Mortgage Rocket Mortgage

For Sale 62065 Hwy 846 Stirling Alberta T0k2e0 A2008995 Realtor Ca

How Much Is The Nyc Mortgage Recording Tax In 2023

Publication 936 2022 Home Mortgage Interest Deduction Internal Revenue Service

Nyc Mortgage Recording Tax Calculator Interactive Hauseit

The Washington Cpa 2022 Fall By Washington Society Of Cpas Issuu

Cryptocurrency Tax Accountants Coinpanda

Indiaherald100114 By India Herald Issuu

39 92ac Luella Rd Sherman Tx 75090 26 Photos Mls 20001673 Movoto

What You Should Know About Property Taxes In California Nicki Karen

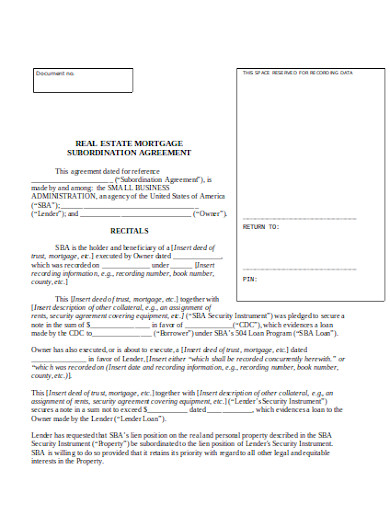

10 Mortgage Fee Agreement Templates In Pdf Word

A Guide To Underwriting Multifamily Property Tax Tactica Real Estate Solutions